It’s true that, with the rise of ride-sharing companies like Uber and Lyft, consumers are more hesitant to buy cars. Automotive repair is definitely one of the most profitable businesses. The calculations discussed so far assume a single amount. Reportedly, the forecast for the general automotive repair’s revenue for 2024 will be 7.62 billion higher than in 2021. The “1” in the factor is the original R1,000, and the 0.1576 is the total earnings over three years.The earnings over three years total R63, and the future value table factor (using the link above) for 3 years at 5% is 1.1576.

#Future value of continuously invested annual moneymoney manual#

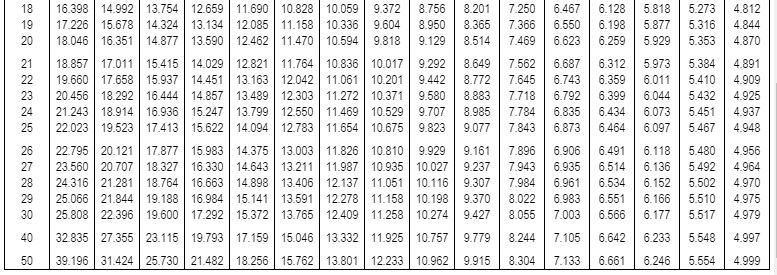

The manual calculation gives you the same result (with rounding) as the future value tables: You earn an extra R2.50 in year two, and the year three earnings are R5.13 greater than year one. A total of 12,000 is invested in two funds paying 9 and 11 simple interest.If the interest for the first year is 1,180, how much of the 12,000 is invested at9a. By investing year one earnings of R50, you earn R52.50 in year two.Īs the number of periods increases, the additional amount of money you earn from compounding also increases. What is the future value of 250,000 invested at a continuously compoundedannual rate of 5, after 3 years Round your answer to whole dollarsa. The total amount invested in year two is R1,050-which, invested at 5%, produces R52.50 in interest. In year two, you keep the original R1,000 invested, plus the year one earnings of R50. You can use the following two formulas to calculate present value and future value without periodical payments. Assume that you invest R1,000 at a 5% interest rate in year one, which generates annual interest of R50. The calculation of time value of money (TVM) depends on the following inputs: present value (PV), future value (FV), the value of the individual payments in each compounding period (A), the number of periods (n), the interest rate (r). Here’s a simple example to understand the math behind compounding interest.

0 kommentar(er)

0 kommentar(er)